Slower global growth, tightening monetary conditions and elevated inflation weigh on growth outlook and sustainable development

Beirut, January 2024 – Western Asia’s economic outlook is deteriorating amid escalating conflicts, declining oil production, and limited macroeconomic policy space, according to the UN World Economic Situation and Prospects (WESP) 2024.

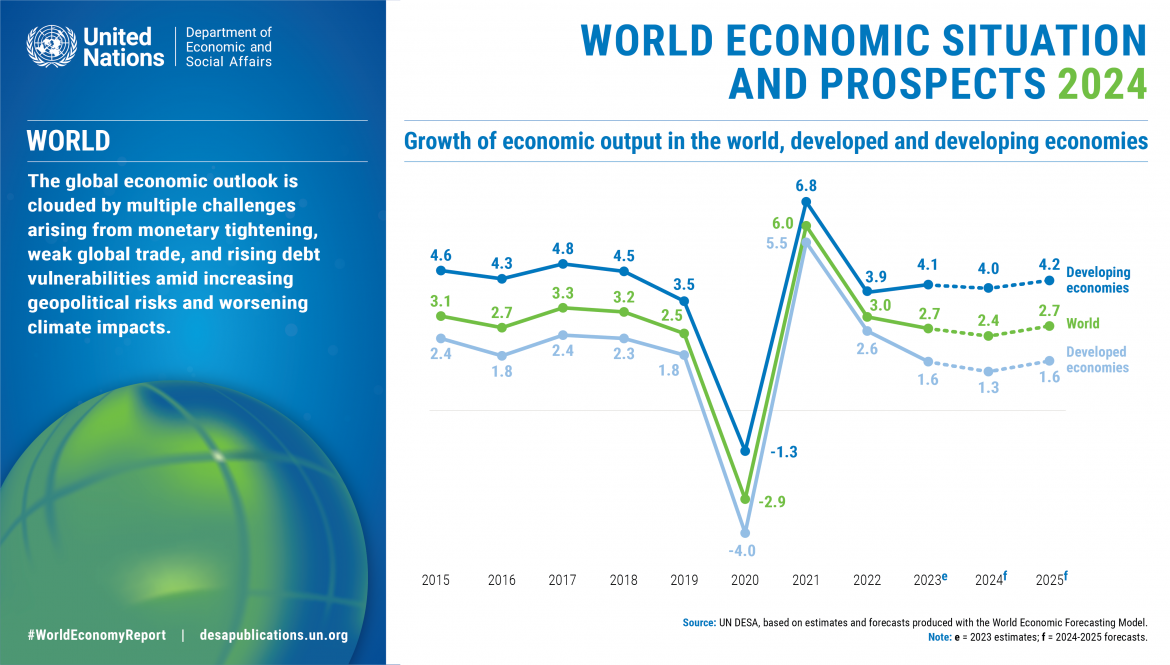

The UN’s flagship economic report presents a sombre global economic outlook for the near term. Persistently high interest rates, further escalation of conflicts, sluggish international trade, and increasing climate disasters, pose significant challenges to global growth. Global economic growth is projected to slow from an estimated 2.7 per cent in 2023 to 2.4 per cent in 2024, trending below the pre-pandemic growth rate of 3.0 per cent.

The prospects of a prolonged period of tighter credit conditions and higher borrowing costs present strong headwinds for a world economy saddled with debt, while in need of more investments to resuscitate growth, fight climate change and accelerate progress towards the Sustainable Development Goals (SDGs).

“2024 must be the year when we break out of this quagmire. By unlocking big, bold investments we can drive sustainable development and climate action, and put the global economy on a stronger growth path for all,” said António Guterres, United Nations Secretary-General. “We must build on the progress made in the past year towards an SDG Stimulus of at least $500 billion per year in affordable long-term financing for investments in sustainable development and climate action.”

Western Asia faces a challenging economic outlook

Economic performance in Western Asia deteriorated in 2023. Regional GDP growth expanded by an estimated 1.7 per cent in 2023 against the backdrop of political instability and escalating conflicts. Major oil producers in the region experienced a sharp slowdown in GDP growth due to voluntary cuts in oil production. Despite the contraction in the hydro-carbon sector, non-hydrocarbon sectors remained resilient. Economic growth in non-oil-producing countries is projected to moderate.

Average growth in the Gulf Cooperation Council (GCC) economies slowed down in 2023 due to less favourable oil market prospects. Saudi Arabia announced additional production cuts during 2023, leading to further contraction in its oil sector. As a result, economic growth is estimated to be around zero in 2023. The robust and steady expansion of the non-hydrocarbon sectors, together with rising oil output, will drive a projected GDP expansion of 3.2 per cent in 2024. Economic growth in Türkiye is estimated to have slowed to 3.5 per cent in 2023 after the country was struck by a series of earthquakes that resulted in widespread damage and tens of thousands of fatalities. GDP growth is projected to decline further to 2.7 per cent in 2024.

Political instability and escalating conflicts overshadow growth prospects in region

The ongoing conflict between Israel and Hamas has further exacerbated the situation in Gaza, unfolding a catastrophic humanitarian crisis in the fourth quarter of 2023. The loss of human lives, the sharp decline in economic activities and the destruction of productive capacities impose not only immediate losses, but also lingering long-term damage to potential output and socioeconomic development in the State of Palestine.

Monetary and fiscal policy face mounting challenges

Monetary tightening has accelerated, albeit for differing reasons across the region. The inflation rate in GCC economies has declined sufficiently but central banks maintained a tight monetary stance to maintain the currency peg with the US dollar. In Türkiye, years of unconventional monetary policies and low interest rates largely failed to boost productivity and economic growth, resulting in a weak domestic currency and soaring inflation. To curb inflation, the Central Bank increased the policy rate five times between June and October 2023.

The fiscal position in the region remains very challenging. Energy-producing countries face declining oil prices and curtailed oil production in 2023. The fiscal deficit is expected to average 4.1 per cent of GDP during the period 2023–2025. The drop in oil production in 2023 and elevated inflation rates will limit the fiscal space and widen fiscal deficits. Furthermore, several countries have either expanded their subsidy coverage or have adopted other targeted measures to mitigate the impact of elevated inflation rates on vulnerable households. These measures will exert additional pressures on budgets, widening fiscal deficits.